Trading Guide

Candlesticks

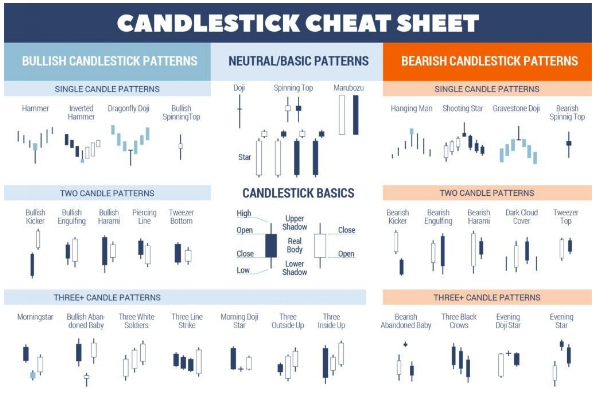

Candlesticks serve as an important way to track the market’s behaviour and possible future direction. Introduced from Japan, Western traders used to only use bar charts and point and figure charts for trading commodities and stocks. Candlesticks provide a more powerful analysis as they reveal more information from the market. The open and close of the candlestick represent the ‘body’ while the highs and lows are represented by ‘wicks’.

Analysis

The patterns and formations of candlesticks can provide information on where to buy and sell cryptocurrencies, as well as when to exit these positions. We will look at two simple, reliable candlestick patterns that frequently occur in cryptocurrency markets that will allow you to trade and invest more effectively. It is recommended only to rely on candlestick analysis with timeframes higher than 4 hours to provide stronger signals.

Buy Orders

Limit

Market orders allow us to exchange any amount of coin right away at the current market price. Orders are filled using the best available price in the exchange’s order book. For example, if you placed a market buy order for $100, it would buy from the lowest priced sell order(s) until you had used that $100. The advantage is that this transaction is always completed immediately; the disadvantage is that we don’t know exactly what price we are going to get.

Market

Limits orders allow us to place an order at a specific price. We can specify the amount of coin that we want to buy or sell, at the price that we want this to happen at. You may have noticed that the order book is always full of sell orders that are a little higher than the current price and buy orders that are a little lower. The advantage with limit orders is that we can do do the same with our orders. The disadvantage is that our transaction likely will not be filled immediately and will count on the market price to make its way towards us.

Stop-Limit

Stop limit orders are really only useful when selling coins. They allow us to set a condition: we specify a price, and if the price becomes less than or equal to that price, a market order is automatically placed for us. The advantage here is that if we need to step away and will not be able to watch the price, we have some protection if the market begins to plummet. The disadvantage is that we are counting on there being good buy orders available to fulfill our sells. If a massive amount of market sell orders were to be executed right before your stop is triggered, it’s technically possible to be left with the bottom of the barrel. This has happened before, but is not common.